At 123 Money Loans USA, we totally get it – making good financial decisions is a must! When it comes to borrowing money, you need to know the difference between secured and unsecured loans. That’s why we put together this guide – we’ll break down everything you need to know to help you make the […]

At 123 Money Loans, we understand the importance of building a strong credit history. In today’s financial landscape, creditworthiness plays a crucial role in accessing various opportunities, from securing loans to obtaining favorable interest rates. One common question that arises is whether payday loans can serve as a viable option for building credit. In this […]

Payday loans have gained popularity in recent years for their short-term loans and their promise of quick cash without the need for a credit check, making it an attractive option for many people. However, these loans come with high-interest rates and fees, leading many to get caught in a cycle of debt that can be […]

When you apply for a payday loan, the lender will typically require that you provide proof of employment. This is to ensure that you have a steady source of income and are able to repay the loan. There are a few different ways that lenders can verify your employment. The most common way is for […]

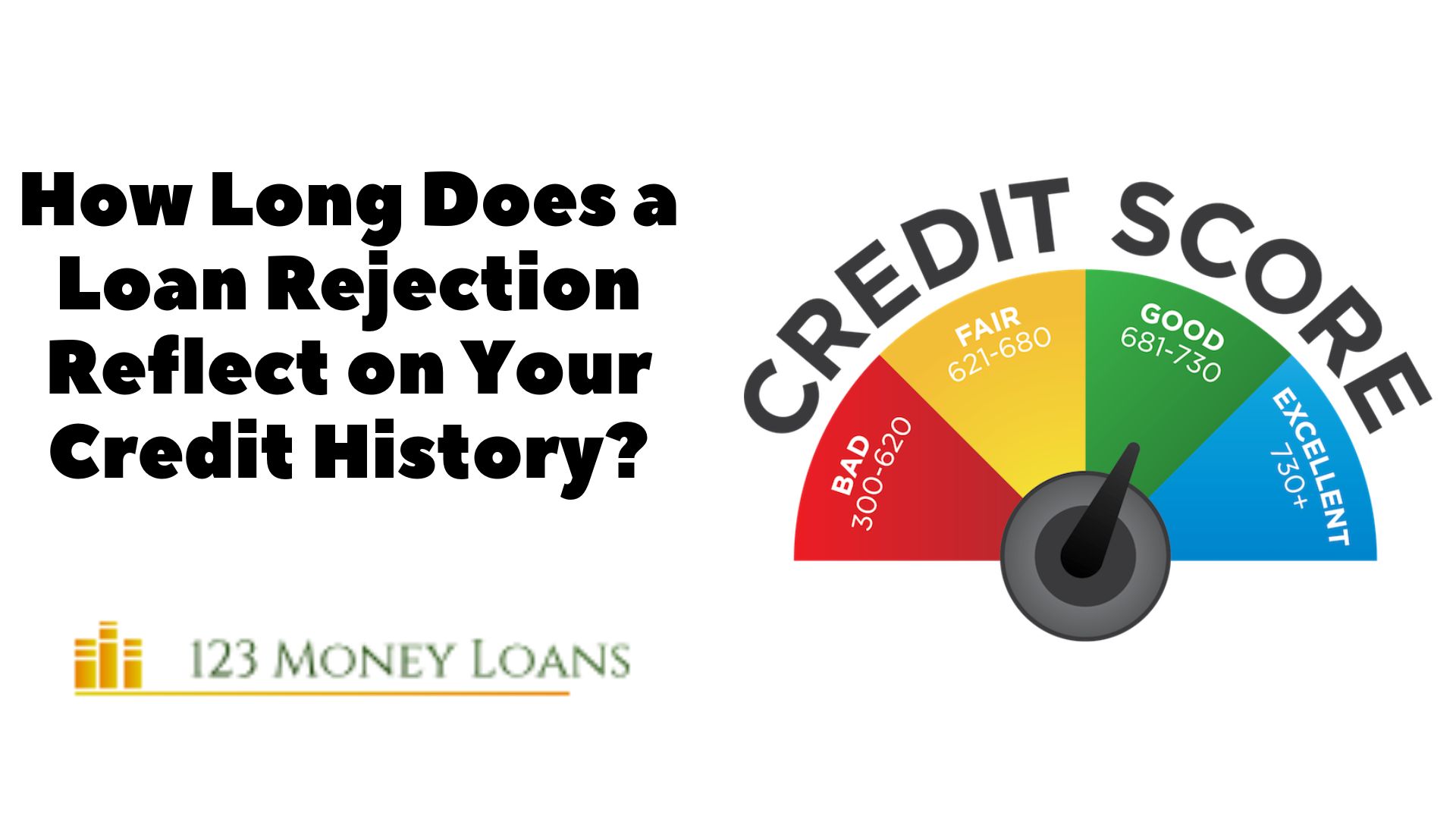

A loan rejection can stay on your credit report for up to seven years. This is because lenders report loan applications and their outcomes to the credit bureaus. So, if you apply for a loan and get rejected, that information will become part of your credit history. Loan rejections can impact your credit score in […]

Payday loans are a quick and convenient way to access emergency funds when you’re in need of cash. But if you find yourself needing another loan soon after, it may be time to reassess your financial situation and figure out how to make better decisions going forward. Taking out a second payday loan can be […]

Legit payday loans are short-term, high-interest loans that are typically used by people who are in a financial bind. These loans are not intended to be used for long-term financial solutions, but rather as a way to get quick cash when you need it most. There are many different lenders that offer legit payday loans […]

When you apply for a payday loan in United States, the lender will typically request your bank account information. This is done so that the lender can deposit the loan amount directly into your account once the loan is approved. The reason why lenders request this information is so that they can ensure that you […]

When you retire, you may be eligible for Social Security benefits. If you are receiving these benefits, you may be able to take out a Social Security payday loan. This type of loan can give you the money you need to cover unexpected expenses or help you make ends meet until your next paycheck arrives. […]

If you need cash now, and have no other options, you may be considering a payday loan. Payday loans are short-term, high-interest loans that can be very difficult to repay. They are typically only given to people who have bad credit, and can be very expensive. Before you take out a payday loan, you should […]

- 1

- 2